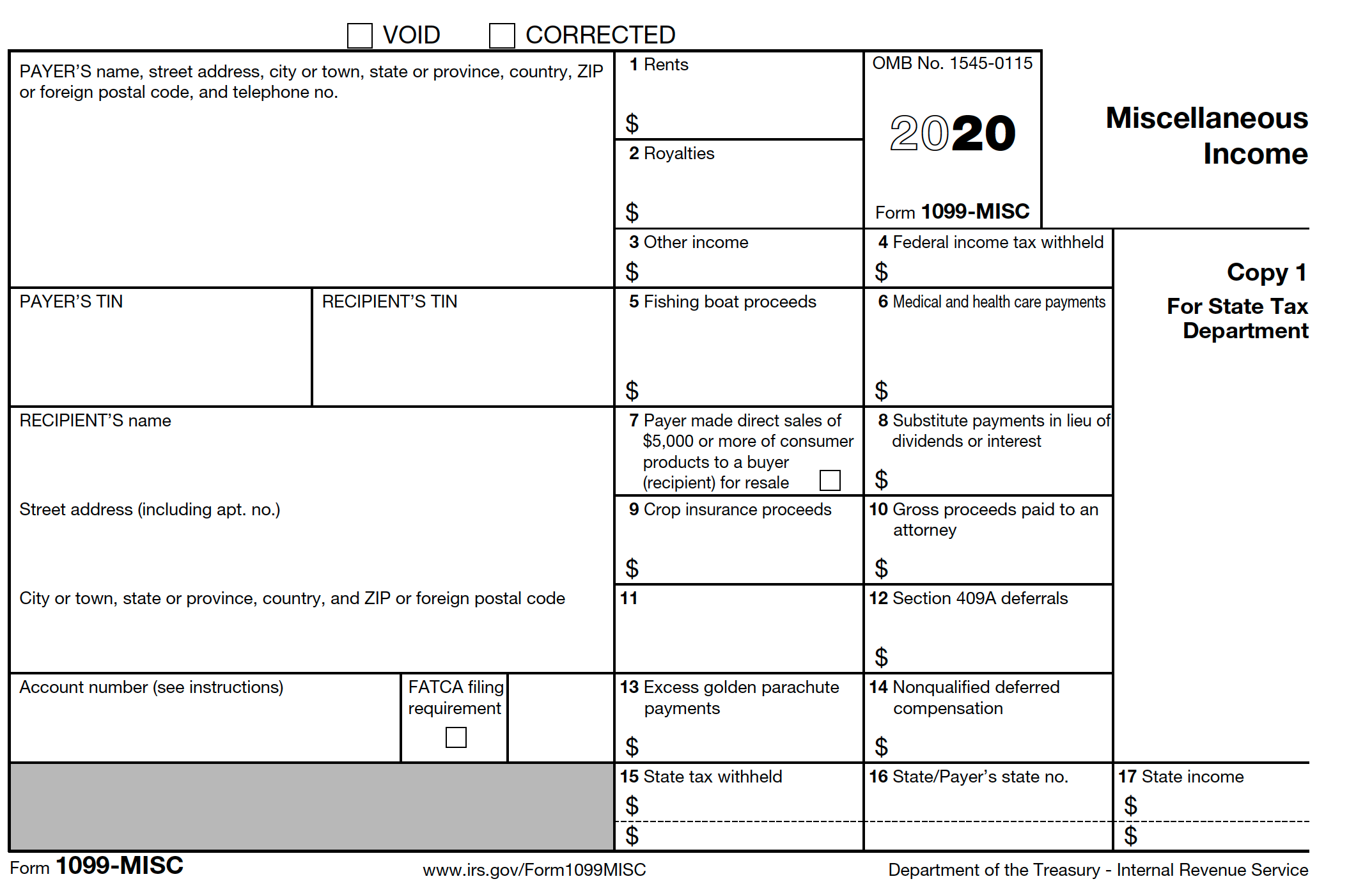

Clients are legally obliged to issue 1099MISC forms to their contractors if the amount they paid warrants that expense If an independent contractor earnsSince then we've ended support for Payable over time and rolled out a new service on Stripe Connect to support 1099 reporting and filing As part of this transition, we ended selfserve access to Payable on If you are a platform, that needs to access data from Payable, please contact Stripe support at supportpayable@stripecomHow to structure your finances as a 1099 contractor About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy & Safety How

5 Reasons I Switched From A Salaried Employee To A 1099 Independent Contractor

1099 independent contractor california

1099 independent contractor california-Our People Technology 24/7 Support Security, Safety, & Hazmat Organizations Company Our History Our Mission Management Team Opportunities Independent Contractors Freight Drivers Office Employment Contact Us LoginHiring independent contractors This setup is widely spread across all company sizes Hiring contractors has multiple benefits the possibility to employ foreign workers or shortterm workers, cost per employee savings, and the ease of contractor relationships Although it's the easiest to set, it can lead to tax evasion charges and IRS audits when local laws and different setups for

Employee Misclassification What Happens When You Mistake An Employee For An Independent Contractor Dominion Systems Dominion Blog

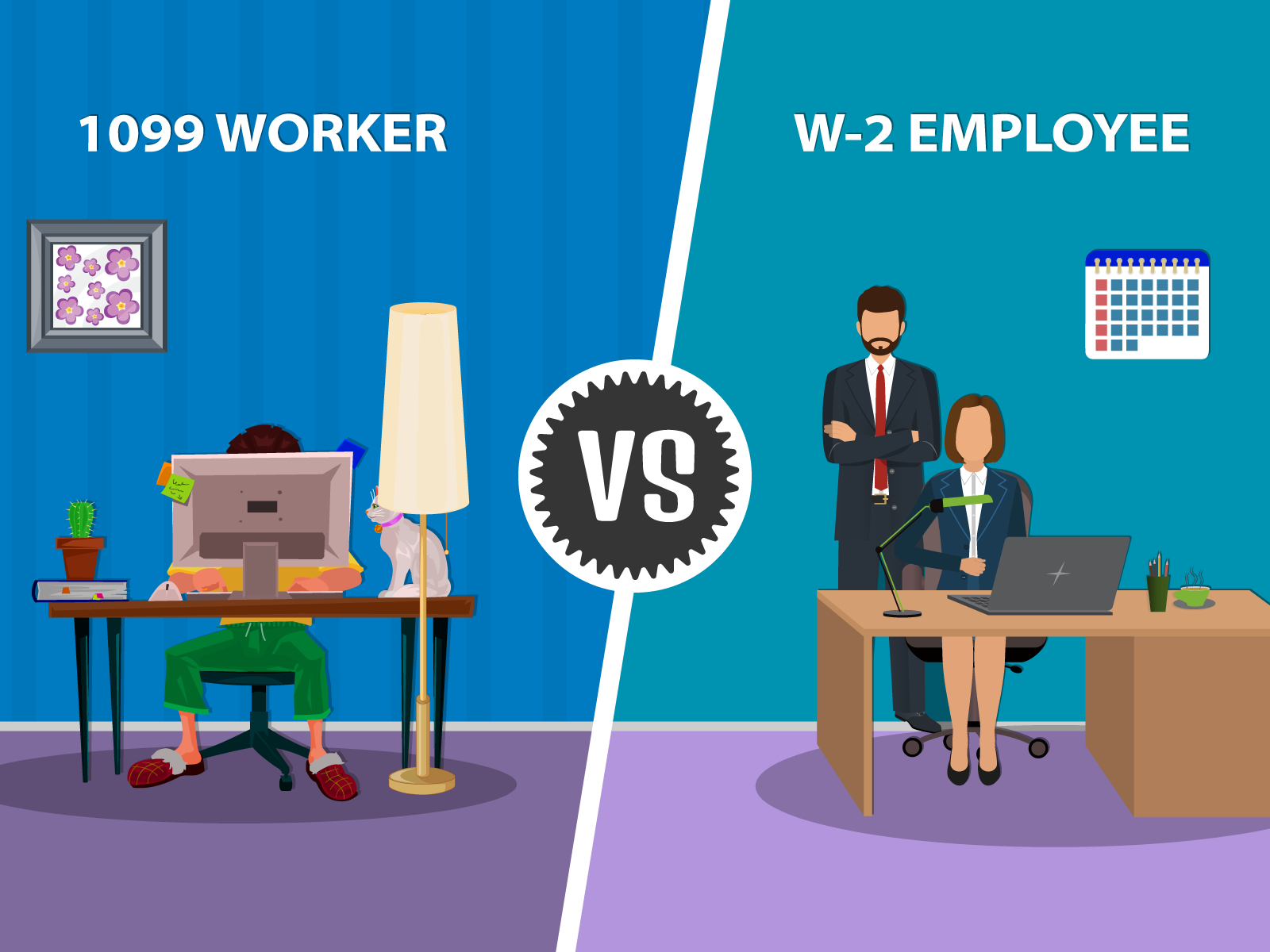

The term 1099 independent contractor refers to a person who provides goods or services to another but not as an employee The recipient of the services or products does not deduct your social security payments or tax withholdings from your payments For purposes of filing taxes, the employer provides the worker with IRS form 1099 instead of a W An independent contractor is selfemployed and receives 1099 forms from each client they did work for during the year An independent contractor fills out a W9 for their client For a sole proprietor , these 1099 forms (along with all the business expenses) flow onto Schedule C and then on to the 1040 The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done The earnings of a person who is working as an independent contractor are subject to SelfEmployment Tax

Simply put, 1099s and W2s are two separate tax forms for two different types of workers If you're an independent contractor, you get a 1099 form If you're an employee, you receive a W2 As a W2 employee, payroll taxes are automatically deducted from your paycheck and then paid to the government through your employerA 1099 employee is a worker who is selfemployed and works as an independent contractor If you are a 1099 employee, it means you are not employed by someone, but you work independently on a projecttoproject basis 1099 employees can work in various fields fulfilling various functions including working as consultants, agents, and brokers How to make more money from 1099 deduction expenses as an independent contractor There are a few things that can be done to write off taxes and make more money 1 Home office An independent contractor or a self employed individual has the liberty to work from their choice of space, which can also be their home

For example, a computer programmer might get paid for hours worked on programming tasks By the Job The other payment alternative is to pay A 1099 Contractor is a name given to selfemployed individuals who trigger the need for a company to issue a Form 1099MISC to document earnings paid to this person for services rendered, beyond $599 An independent contractor is a nonemployee of the companyFor over 23 years, ICON has led the industry in providing Independent Contractor Compliance Vetting and Management services ICON utilizes a highly specialized compliance technology tool combined with a "handson" human interactive process to validate and manage Independent Contractor workers throughout the length of the contractor's assignment

Employee Vs Independent Contractor What S The Difference

Who Should You Hire Independent Contractor Vs Employee Top Echelon

25 Little Known 1099 Independent Contractor Deductions 1 Selfemployment tax This is probably the most confusing and improperly calculated tax for 1099 workers To break it 2 The Home Office Expense Deducting a part of your home can be complex, but essentially you can take a writeoff forIt's another story for freelancers and independent contractors who have their income reported on Forms 1099 If you are earning Form 1099 income you need to know your income tax bracket because you do not have the benefit of employer withholding and must send estimated tax payments to the IRS each quarterIndependent contractor liability insurance, also known as 1099 liability insurance, from The Hartford can help protect you and your contracting business Learn about the general liability insurance independent contractors need

Employee Versus Independent Contractor The Cpa Journal

5 Reasons I Switched From A Salaried Employee To A 1099 Independent Contractor

The 1099Misc listed royalties, rents, and other miscellaneous items, but its most common use was for payments to independent contractors Starting in , the IRS now requires payments to independent contractors are shown on a new form 1099NEC (nonemployee compensation) instead of the 1099MISC (miscellaneous)The penalties for independentcontractor misclassification in California are the largest that the labor code has to offer As an aggrieved current or former employee, you may be able to recover these penalties on behalf of yourself and your coworkers Contact us for a free consultationA 1099 contractor, also known as an independent contractor, is a classification assigned to certain US workers The "1099" reference identifies the tax form that businesses must file with the Internal Revenue Service (IRS), and it relieves the employer from the responsibility of withholding taxes from the individual's paychecks

Free Independent Contractor Non Disclosure Agreement Nda Pdf Word Docx

Ask General Counsel What S The Difference Between A 1099 Contractor And A W 2 Employee Business Insidenova Com

Sole proprietors and independent contractors are selfemployed and are eligible for several of the small business relief programs The Paycheck Protection Program is a loan program to help businesses pay for emergency needs, including paying employees A Sick Leave and Medical Leave tax credit is also available to selfemployed business owners who must takeIt's not simply a matter of knowing to give your worker a 1099 vs W2 tax forms How your workers are classified affects their legal protections (like minimum wage and OT rights), taxation and benefits The 1099 miscellaneous form is one of the legal proofs of income for 1099 independent contractors They can be easily generated through several online generators as long as the contractor has the right information to fill in the forms After generating them, the pay stubs can be printed and stored or sent to the necessary parties

How To Fill Out A W 9 19

Make More Money Become An Independent Contractor

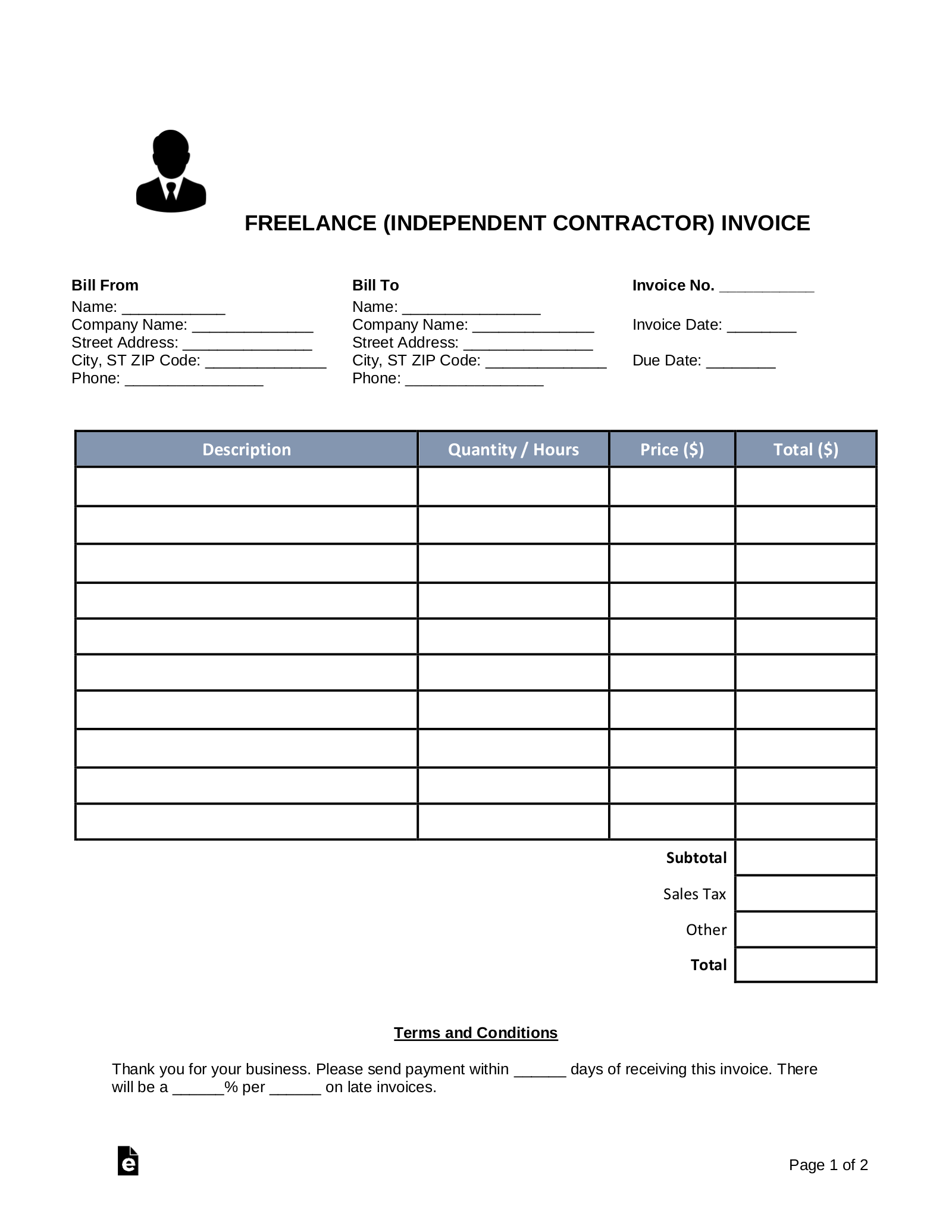

1099 Contractors and Freelancers Most sharing economy workers are 1099 contractors for tax purposes However, you can avoid 1099 contractor status if you formed a corporation for your business The IRS taxes 1099 contractors as selfemployed If you made more than $400, you need to pay selfemployment taxIRS 1099MISC Form – To be filed by the payor of an independent contractor of any individual that was paid more than $10 in royalties, $600 in payments, or $5,000 of a buyer for resale Contractor Work Order – An outlined request that is made prior to a job being assigned that gives a quote of the costs attributed to the labor and materials associated with the work An independent contractor receives compensation in one of several methods, depending on the agreement set up between your company and the contractor Hourly Some contractors get paid on an hourly basis;

Independent Contractor Taxes Guide 21

Employee Vs Independent Contractor Apollomd

What is an Independent Contractor (1099)?The rule was published in the Federal Register on , and was initially scheduled to take effect on See 86 FR 1168 (Independent Contractor Rule) On , the Department published a proposal to delay the Independent Contractor Rule's effective date until , 60 days after the original effective Workers who complete tasks or work on individual projects will fall under a 1099 An independent contractor is able to earn a living on his or her own rather than depending on an employer Independent contractors are often referred to as consultants, entrepreneurs, business owners, freelancers, or as selfemployed individuals

Independent Contractor 1099 Invoice Templates Pdf Word Excel

3

For the past 38 years, businesses filed Form 1099MISC to report payments to independent contractors Form 1099NEC replaces 1099MISC for this purpose starting in 5 File Form 1040 andAccording to the IRS, "independent contractor" includes people such as doctors, dentists, veterinarians, lawyers, accountants, contractors, subcontractors, public stenographers, or auctioneers who are in an independent trade, business, or profession in which they offer their services to the general publicHere are the criteria for determining independent 1099 contractors in Washington State In Washington State, there is a set of six rules used to determine whether a worker is considered an independent contractor or an employee under workers' comp law, with an additional rule for construction workers This test is titled RCW 5 and is

Order Irs 1099 Form 17 Beautiful 1099 Form Independent Contractor Models Form Ideas

Businesses Concerned About Covid 19 Unemployment Benefit Rights For Independent Contractors Independent Contractor Compliance

An independent contractor is a person, business, or corporation that provides goods or services under a written contract or a verbal agreementUnlike employees, independent contractors do not work regularly for an employer but work as required, when they may be subject to law of agencyIndependent contractors are usually paid on a freelance basis Contractors often W2 or 1099 status has a big impact on taxes Here are 3 steps for how you can identify an employee versus an independent contractorIndependent contractors, consultants, contract workers, 1099 "employees", and outsourced staff All of these are names used to refer to individuals who work for you, but are paid outside of payroll there are many benefits to having a handbook specifically developed for these independent members of your teamBefore you write a handbook for them, let's make sure

1

W2 Or 1099 Biggest Mistakes And The Information You Need To Know To Stop Them From Happening Accounting Freedom Solutions

While the income of workers is reported on Form W2 by their employer, independent contractors will collect Forms 1099MISC to report income to the IRS It is a common exchange between independent contractors and their customers As an independent contractor, you won't get a W2 with a tidy list of your income and deductions Instead, every client that paid you more than $600 is required to send you a 1099 contractor form Clients that paid you less than $600 don't have to send one In theory, if you add up all the 1099s you receive, it should be equal to your grossWe combine our industry knowledge, the highest quality building supplies and equipment It is our goal to deliver exceptional service to our clients We will stay in touch, keeping you up to date on both the paperwork and project process Copyright © 1099 Independent Contractors Solutions All Rights Reserved

Free Independent Contractor Agreement Create Download And Print Lawdepot Us

1099 Misc Form Fillable Printable Download Free Instructions

STEP 3 Prepare Your 1099 MISC Forms Start preparing 1099 MISC forms for independent contractors, once you have bought the 1099 forms Fill in your Federal Tax ID number (SSN or EIN) and contractor's information (SSN or EIN) accurately Ensure you enter the same amount of money you paid to the contractor in Box 7 under the title "Nonemployee compensation" An independent contractor is essentially a trained professional who works in their own time In basic terms, you are considered selfemployed You may be hired by someone to do a job, but how you go about completing the task is typically determined by you What Is a Form 1099NEC Beginning with tax year , Form 1099NEC replaces the previously used Form 1099MISC for independent contractors This form is used by companies to report payments made in the course of a trade or business to others for services It must be filed by any company that pays an independent contractor $600 or more during the year

How To File A Tax Return With A 1099 Independent Contractor Tax Preparation Youtube

New Jersey Continues Its Push To End The Misclassification Of Employees As Independent Contractors Morea Law Llc An Employment Law Boutique

Workers Compensation Attorney Law Firm in Los Angeles, advocates for the rights of independent contractors as far as meal and rest breaks for 1099 workers are concerned If you feel that your rights have been violated and you deserve some form 1099 vs W2 Worker classification is how you determine whether a worker is an employee or an independent contractor What's at stake? Independent Contractors, on the other hand, are usually provided with a completed copy of IRS Form 1099MISC (Opens in new window) by the business that paid them To determine whether a worker is an employee or an independent contractor, the Internal Revenue Service (the IRS) looks primarily at whether the business has the right to control the

Free Freelance Independent Contractor Invoice Template Word Pdf Eforms

1099 Workers Vs W 2 Employees In California A Legal Guide 21

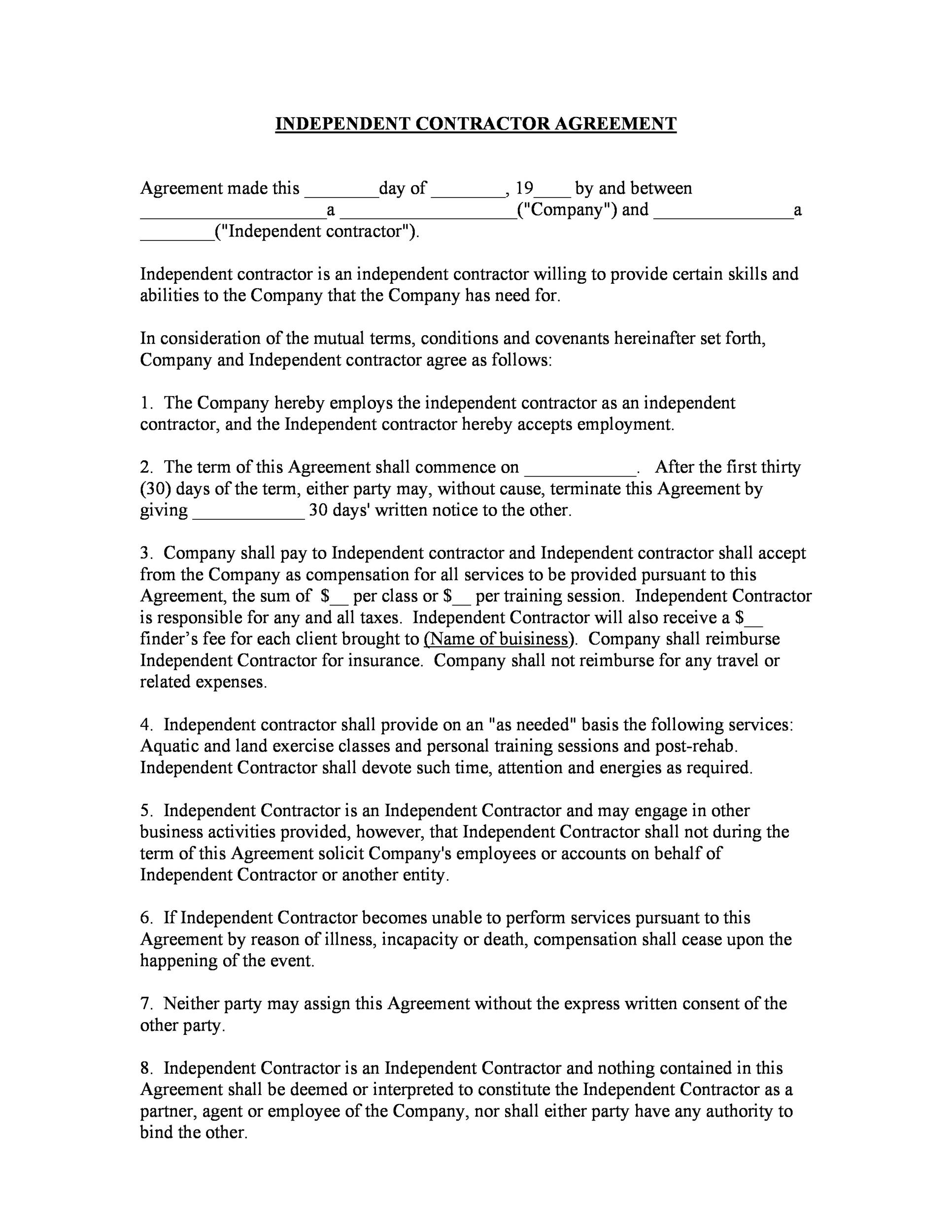

Generally, if you're an independent contractor you're considered selfemployed and should report your income (nonemployee compensation) on Schedule C (Form 1040), Profit or Loss From Business (Sole Proprietorship) Most selfemployed individuals will need to pay selfemployment tax (comprised of social security and Medicare taxes) if their income (net earningsHowever, 1099 independent contractors can only go to court to settle their disputes and to enforce other rights under the contract agreement You Signed an Agreement as an Independent Contractor When starting a job, an employer may make you sign an agreement outlining that you are an independent contractor As of , PPP applications are open again If you're a sole proprietor (1099) and are interested in beginning your application process, start here We have again teamed up with Lendio, with whom we helped facilitate over

Employee Versus Independent Contractor The Cpa Journal

How To Become A 1099 Independent Contractor As A Physician Assistant Youtube

W2 Employee Versus 1099 Independent Contractor Compliance Checklist Liquid

Does An S Corp Get A 1099 Misc Or 1099 Nec Infographic

How Do I Know If I Should Hire An Employee Or An Independent Contractor Ledger Harmony Bookkeeping For Small Businesses

Taxes As An Independent Contractor France Law Firm

1099 Misc Form Fillable Printable Download Free Instructions

Hiring Independent Contractors Vs Full Time Employees Pilot Blog

1099 Misc Form Fillable Printable Download Free Instructions

Wrongful Termination For 1099 Independent Contractors Workers Compensation Attorney

W 9 Vs 1099 Understanding The Difference

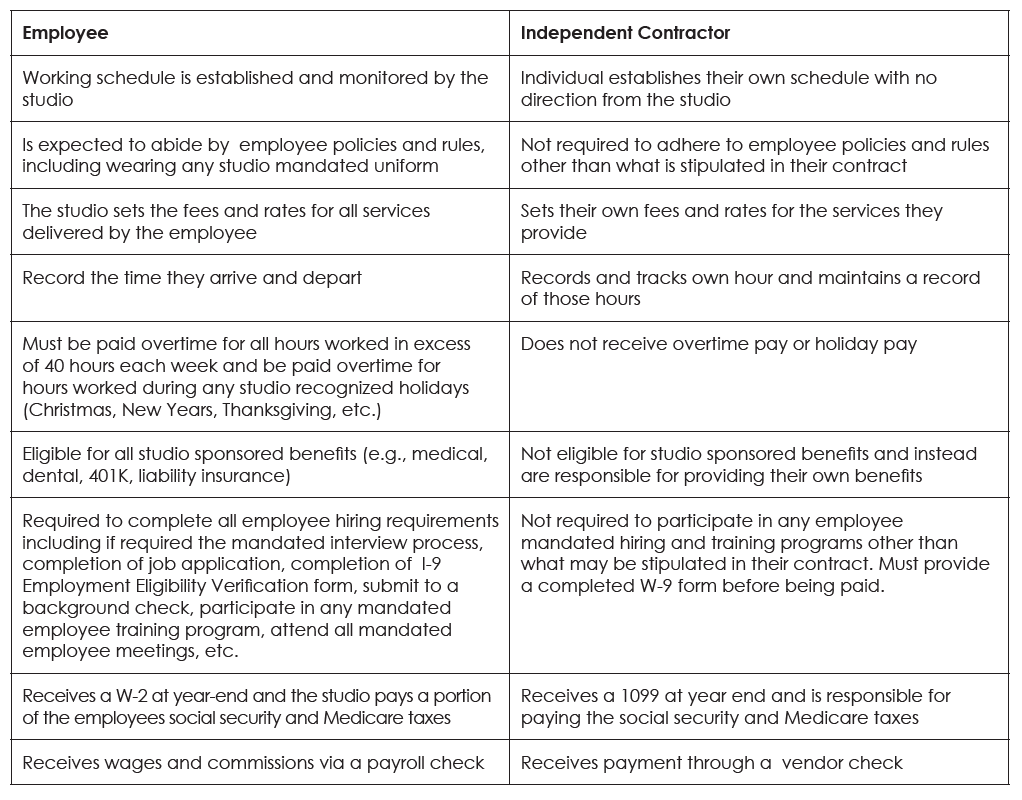

Employee Or Independent Contractor Which One Is Best For My Business The Association Of Fitness Studios

Www Pgpbenefits Com Wp Content Uploads Bsk Pdf Manager Independent Contractor Attestation 962 Pdf

/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

How To Report And Pay Taxes On 1099 Nec Income

W2 Employee Or 1099 Independent Contractor A5 New Law In Ca

What Is Form 1099 Misc When Do I Need To File A 1099 Misc Gusto

Change Is A Good Thing Hype S Talent Is All W2 Variable Hour Employees

How To Pay Tax As An Independent Contractor Or Freelancer

Instant Form 1099 Generator Create 1099 Easily Form Pros

What Is The 1099 Form For Small Businesses A Quick Guide

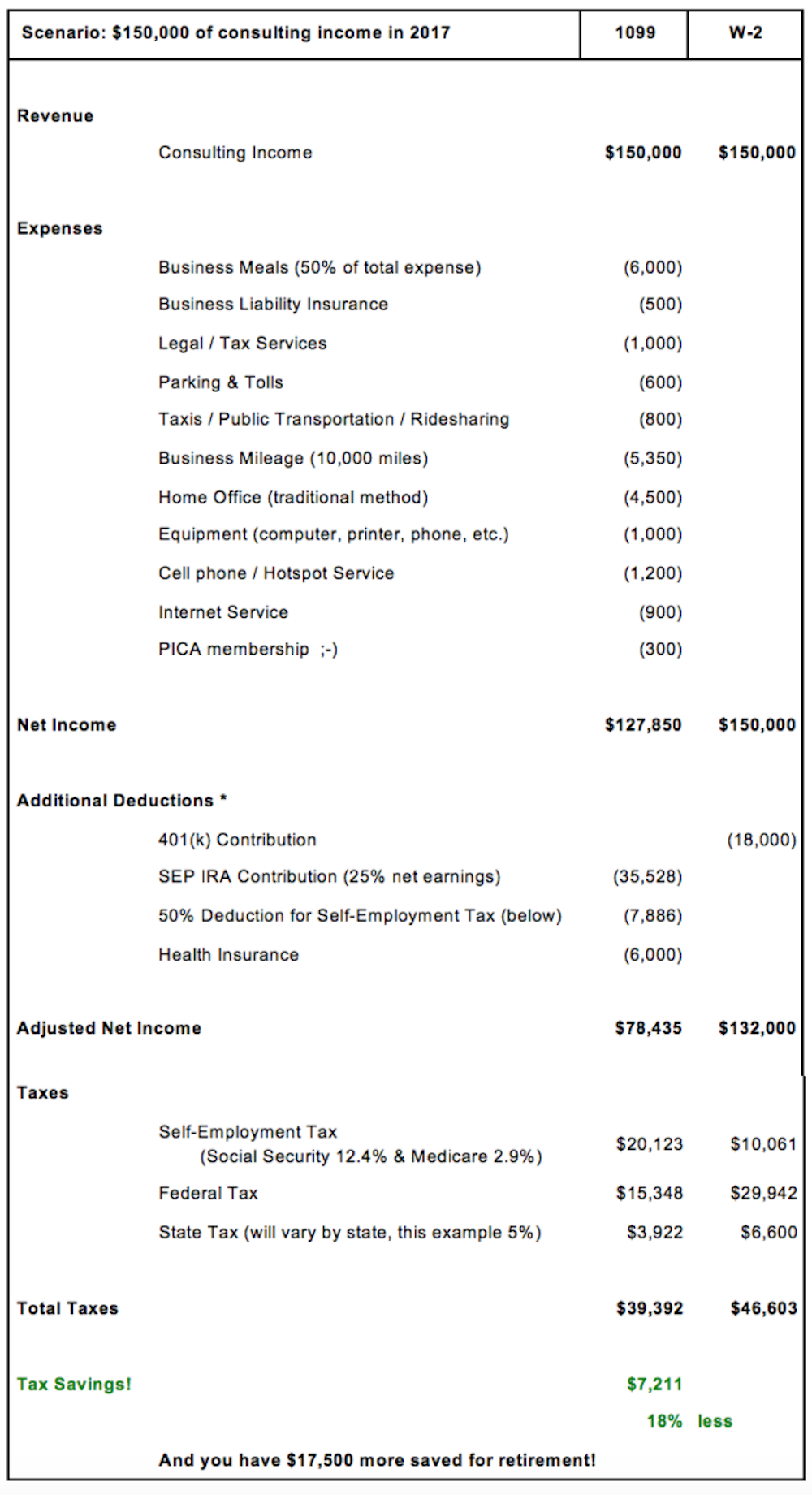

1099 Vs W2 Pica Pica

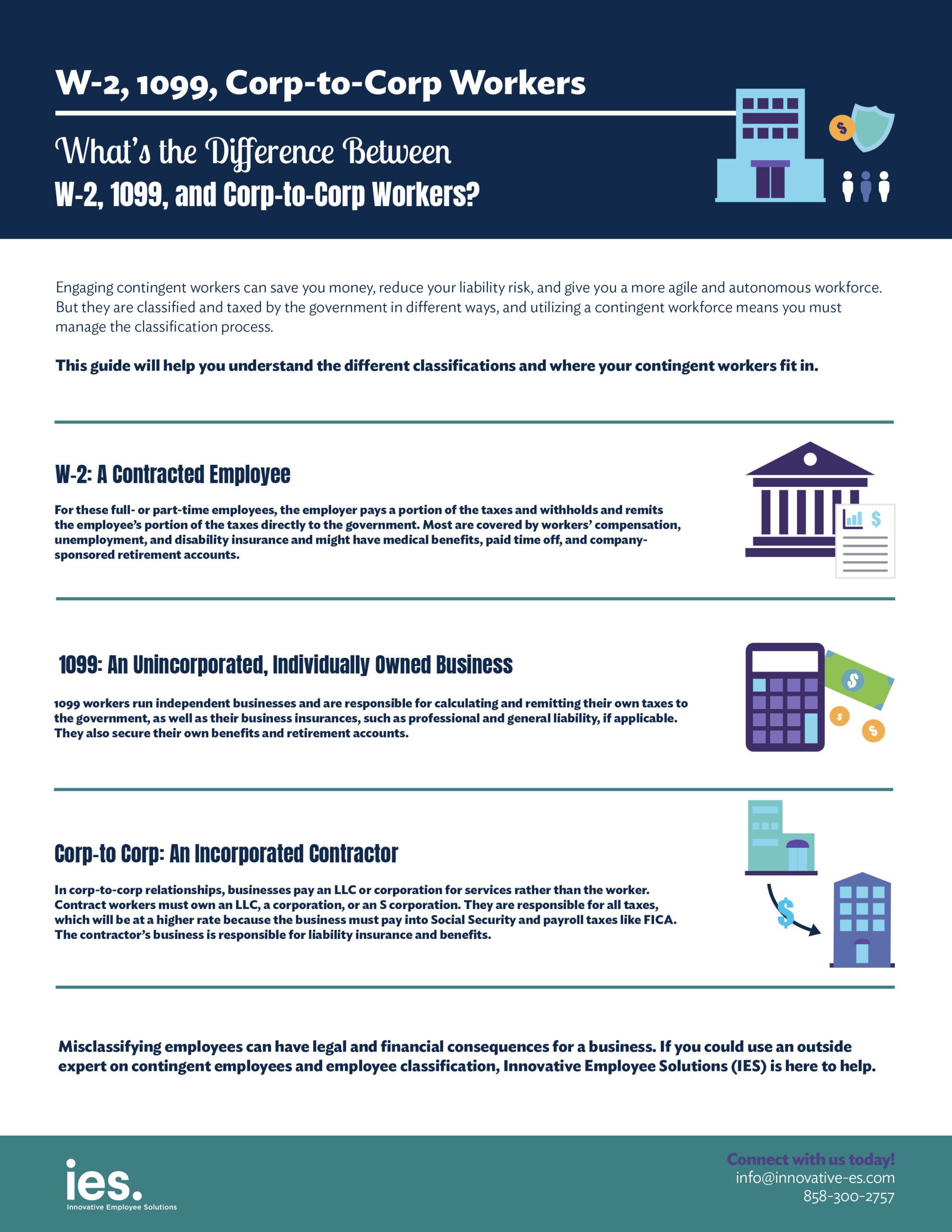

What S The Difference Between W 2 1099 And Corp To Corp Workers

Free Independent Contractor Agreement Pdf Word

What If A Contractor Or Vendor Refuses To Provide A W 9 For A 1099 Politte Law Offices Llc

Updated 1099 Filing Guide For Business Owners Joshua B Crutcher

Do You Need A W 2 Employee Or A 1099 Contractor How To Start Grow And Scale A Private Practice Practice Of The Practice

Ep90 Independent Contractor Vs W 2 Employees Pool Chasers Podcast

Hiring Guide For 1099 Independent Contractors Legalities Forms Taxes Exaktime

How U S Companies Harm Workers By Making Them Independent Contractors Equitable Growth

How To Manage 1099 Sales Reps Independent Contractors

Understanding The Differences Between Hiring An Employee Or An Independent Contractor Dcc Accounting

1099 Vs W2 Difference Between Independent Contractors Employees

1099 Vs W2 Difference Between Independent Contractors Employees

Independent Contractor 1099 Invoice Templates Pdf Word Excel

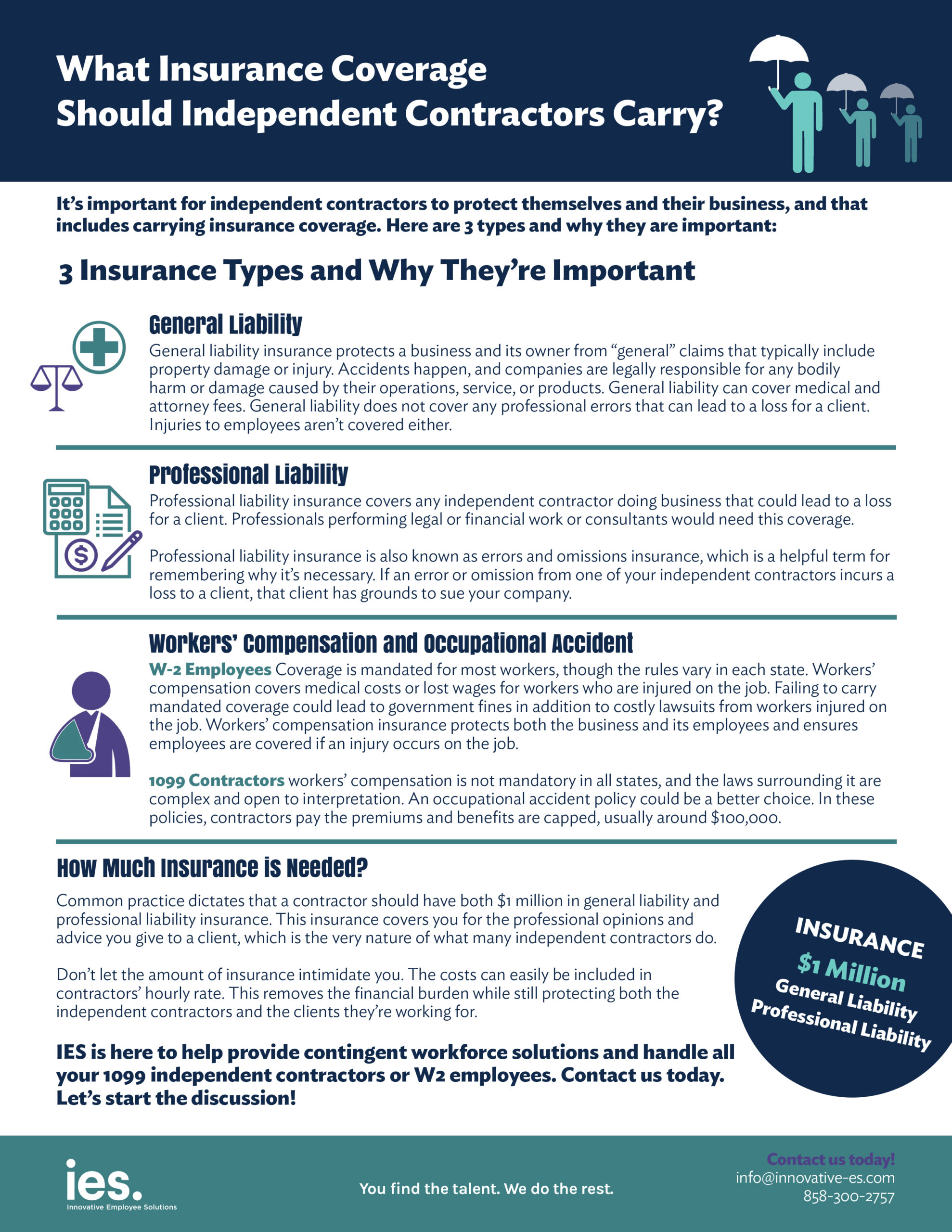

What Insurance Coverage Should Independent Contractors Carry

1

Blog Employee Or Independent Contractor Know The Difference Dynamic Office Accounting Solutions

Form Irs 1099 Misc Fill Online Printable Fillable Blank Pdffiller

Paid Family And Medical Leave Exemption Requests Registration Contributions And Payments Mass Gov

50 Free Independent Contractor Agreement Forms Templates

50 Free Independent Contractor Agreement Forms Templates

Everything You Need To Know About Paying Contractors Wave Blog

What Is A 1099 Misc Stride Blog

Truck Driver Independent Contractor Agreement Best Of 1099 Contractor Form What Is A Misc Form Financial Strategy Center Models Form Ideas

1099 Form Independent Contractor Agreement Unique 1099 Form Independent Contractor Agreement Example Forms For Models Form Ideas

Independent Contractor Invoice Template Free Beautiful 7 Independent Contractor Invoice Invoice Template Estimate Template Excel Budget Template

W9 Vs 1099 A Simple Guide To Contractor Tax Forms Bench Accounting

Independent Contractor 1099 Invoice Templates Pdf Word Excel

Tax Deductions For Independent Contractors Kiplinger

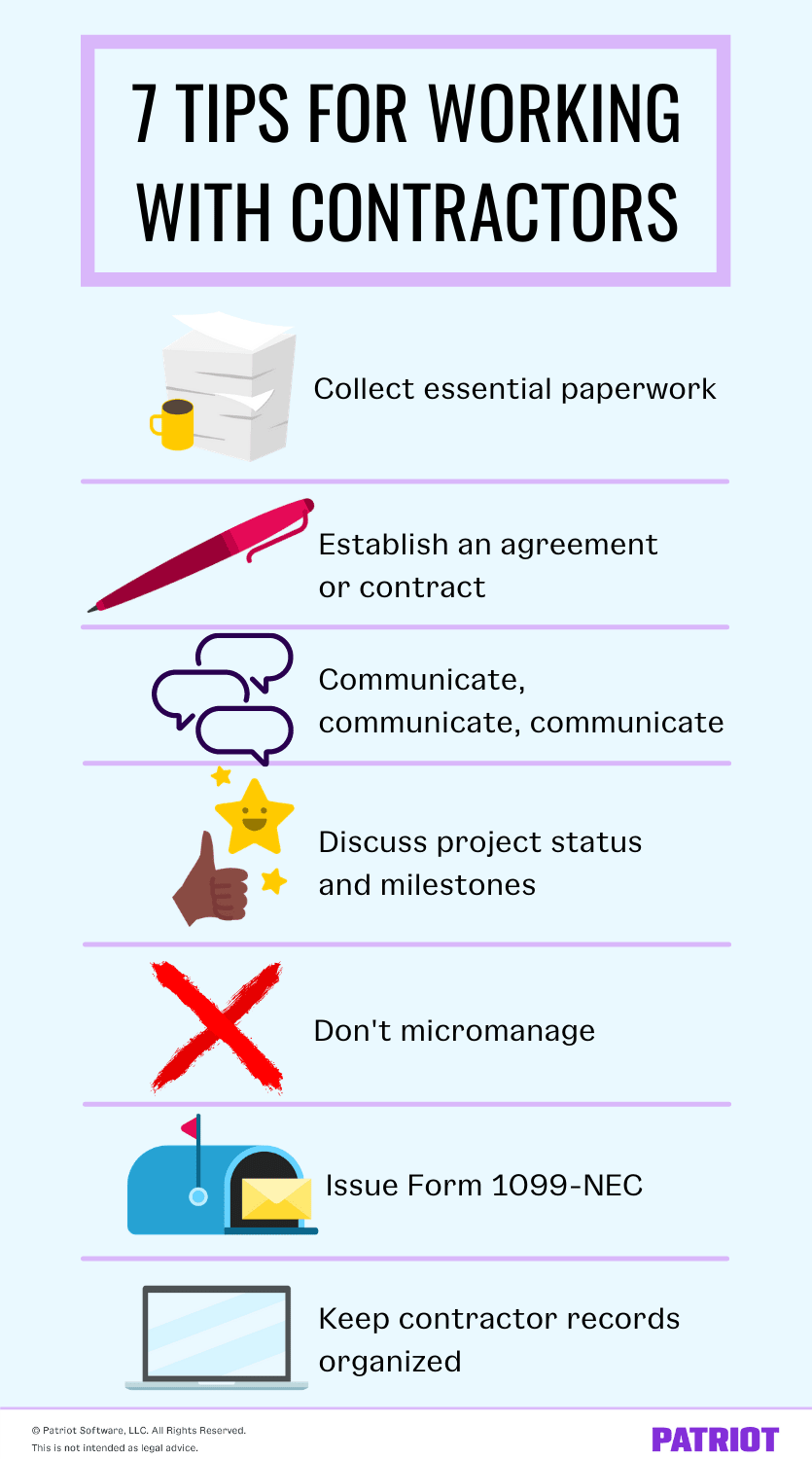

Working With Independent Contractors Business Guidelines

Do Your Employees Require A 1099 Or W 2 Employee Or Independent Contractor

Free One 1 Page Independent Contractor Agreement Pdf Word Eforms

My Employer Says I M An Independent Contractor Does L I Cover Me

/how-to-report-and-pay-independent-contractor-taxes-398907-FINAL-5bb27d1846e0fb0026d95ba3.png)

Tax Guide For Independent Contractors

/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

How To Report And Pay Taxes On 1099 Nec Income

17 Tests To Decide Employee Or Independent Contractor Dasco Insurance Agency Northbrook Il

W 2 Archives Vensurehr

How To Pay A 1099 Independent Contractor Gusto

Abc Test Passed Into Law What Happens Now Solopoint Solutions Inc

Free Florida Independent Contractor Agreement Word Pdf Eforms

Independent Contractor Vs Employee What Can These Workers Offer Your Business Paychex

Employee Misclassification What Happens When You Mistake An Employee For An Independent Contractor Dominion Systems Dominion Blog

Http Www Aesi Com Wp Content Uploads 16 01 Risks With 1099s Pdf

The Amazing 1099 Checklist For Independent Contractors

Why Should A Brand Ambassador Be Treated As A W 2 Employee Not A 1099 Independent Contractor The Hype Agency

Solved How To Prepare 1099 Miscs For Independent Contractors In Quickbooks Online Plus

1099 Misc Instructions And How To File Square

W 2 Employees Vs 1099 Contractors Due

Free Independent Contractor Agreement Templates Pdf Word Eforms

Www Uncsa Edu Mysa Faculty Staff Working At Uncsa Financial Services Purchasing Purchasing Forms Docs Ic Reimbursement Guide Pdf

/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

How To Report And Pay Taxes On 1099 Nec Income

12 Myths About Independent Contractors Debunked By Dol Infographic Employers Resource

Q Tbn And9gcr A0xynxdhhxxfl7nxp1 Ksov2b3i1bqvj6yqi0itop9kghngk Usqp Cau

Wrongful Termination For 1099 Independent Contractors Workers Compensation Attorney

When Is Tax Form 1099 Misc Due To Contractors Godaddy Blog

/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

How To Report And Pay Taxes On 1099 Nec Income

How To File A Tax Return With A 1099 Independent Contractor Tax Preparation Youtube

What Is A 1099 Vs W 2 Employee Napkin Finance

Top 25 1099 Deductions For Independent Contractors

How To File The New Form 1099 Nec For Independent Contractors Using Turbotax Formerly 1099 Misc Youtube

The Problem With A 1099 Independent Contractor Vs A W 2 Employee

Is Your Worker A 1099 Contractor Or A W2 Employee Visual Ly

0 件のコメント:

コメントを投稿